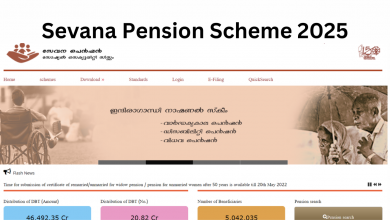

Atal Pension Yojana 2025

The Atal Pension Yojana (APY) is a government-backed pension scheme launched in India to provide financial security to the unorganized sector during their old age. Named after former Prime Minister Atal Bihari Vajpayee, this scheme aims to bring retirement planning within the reach of millions who lack formal pension coverage. In this article, we will cover all the essential details about the Atal Pension Yojana, including eligibility, benefits, enrollment process, and much more.

What is Atal Pension Yojana?

The Atal Pension Yojana is a pension scheme introduced by the Government of India in 2015. It is primarily targeted at workers in the unorganized sector, such as laborers, domestic workers, small shop owners, and others who do not have access to structured pension plans. The scheme offers guaranteed pensions ranging from ₹1,000 to ₹5,000 per month, depending on the contribution made by the subscriber.

This scheme replaces the earlier Swavalamban Yojana, which had limited success. The APY comes under the purview of the Pension Fund Regulatory and Development Authority (PFRDA).

Key Features of Atal Pension Yojana

- Guaranteed Pension: Subscribers receive a fixed monthly pension ranging between ₹1,000 and ₹5,000, depending on their contributions and the age at which they join.

- Government Co-Contribution: The government contributes 50% of the subscriber’s contribution or ₹1,000 per annum, whichever is lower, for a period of 5 years. However, this benefit is only available to subscribers who joined the scheme between June 1, 2015, and December 31, 2015, and are not part of any other statutory social security scheme.

- Low Contribution: The scheme allows individuals to contribute small amounts monthly, quarterly, or half-yearly, making it affordable for low-income earners.

- Tax Benefits: Contributions made to the APY are eligible for tax deductions under Section 80CCD of the Income Tax Act.

- Nomination Facility: Subscribers can nominate a family member, usually a spouse, to receive benefits in case of their untimely demise.

- Flexibility: Subscribers can change the pension amount once a year.

Eligibility Criteria

To enroll in the Atal Pension Yojana, individuals must meet the following criteria:

- Age: The individual must be between 18 and 40 years old.

- Bank Account: A savings account in a bank or post office is mandatory.

- Aadhaar Card: An Aadhaar number is recommended for ease of identification and benefits.

- Income: The scheme is open to all citizens but focuses on workers in the unorganized sector.

Contribution Structure

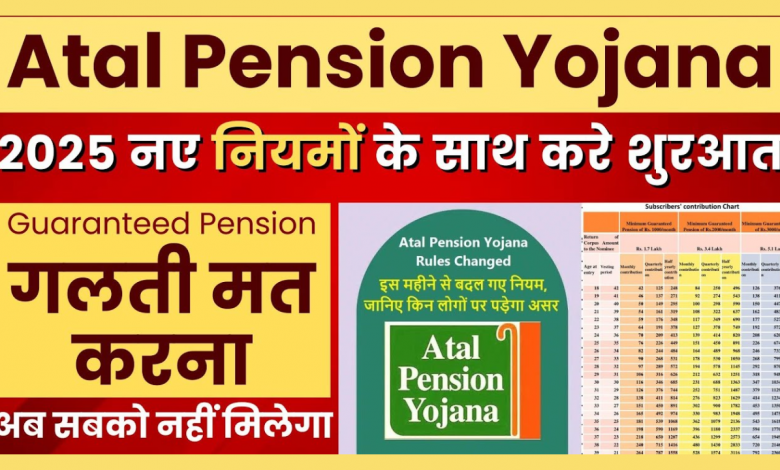

The contributions to the APY depend on the desired monthly pension and the age at which the individual joins the scheme. For instance, a person joining at the age of 18 and opting for a ₹1,000 monthly pension would contribute ₹42 per month, while someone joining at 40 years for the same pension would contribute ₹291 per month.

The table below provides an example of the contributions required for different pension amounts:

| Entry Age | Pension (₹) | Monthly Contribution (₹) |

|---|---|---|

| 18 | 1,000 | 42 |

| 18 | 5,000 | 210 |

| 30 | 1,000 | 116 |

| 30 | 5,000 | 577 |

How to Enroll in Atal Pension Yojana?

Enrolling in the Atal Pension Yojana is simple and can be done through banks and post offices. Here’s the step-by-step process:

- Visit Your Bank or Post Office: Go to the branch where you hold a savings account.

- Obtain the APY Form: Request the Atal Pension Yojana application form or download it from the bank’s website.

- Fill the Form: Provide your personal details, such as name, age, contact information, and Aadhaar number.

- Choose Pension Amount: Select your desired pension amount from the available options.

- Nomination: Nominate a family member to receive benefits after your death.

- Submit the Form: Submit the completed form along with a copy of your Aadhaar card.

- Enable Auto-Debit: Ensure your account is linked to auto-debit for contributions.

Once the application is processed, you will receive a confirmation message.

Benefits of Atal Pension Yojana

- Financial Security: The scheme provides a steady source of income after retirement, ensuring financial independence.

- Inclusive: It covers millions of people who were previously excluded from formal pension schemes.

- Encourages Savings: Regular contributions help build a disciplined savings habit.

- Family Protection: In case of the subscriber’s demise, the spouse or nominee will receive the accumulated amount or pension.

- Low Risk: Being government-backed, the scheme is considered safe and reliable.

Withdrawal and Exit Rules

The withdrawal rules of APY are as follows:

- Before 60 Years: Premature exit is allowed only in exceptional circumstances, such as terminal illness or death. The accumulated corpus is returned to the nominee.

- At 60 Years: Subscribers can start receiving their monthly pension as per the chosen plan.

- Death of Subscriber: The spouse can either continue the scheme or withdraw the accumulated corpus.

Limitations of Atal Pension Yojana

While the APY has numerous advantages, it also has some limitations:

- Age Restriction: Only individuals between 18 and 40 years can join the scheme.

- Fixed Pension: The maximum pension is capped at ₹5,000 per month.

- Contribution Period: Subscribers need to contribute for at least 20 years to receive benefits.

Frequently Asked Questions (FAQs)

- Can NRIs Join APY? Yes, Non-Resident Indians (NRIs) can join the scheme if they have a savings account in India.

- What Happens if I Miss a Contribution? Missed contributions attract penalties, ranging from ₹1 to ₹10 per month, depending on the amount.

- Can I Change My Pension Amount? Yes, subscribers can change their pension amount once a year by submitting a request to their bank.

- Is APY Taxable? Contributions to the APY are tax-deductible under Section 80CCD. However, the pension received after retirement is taxable.